BY Alie McArdle

6 years ago

What is it?

Taxes can be confusing. What do I need to pay, why do I need to pay it? I need to file these when? The questions seem to go on and on regarding what information you need to know to accurately file. A 2290 tax form is for “heavy highway vehicle use.” Commercial trucks that weigh over 55,000 pounds or more are subjected to it. The purpose of the tax is because according to the IRS “heavy vehicles are the ones that cause major damages to public highways.”

When?

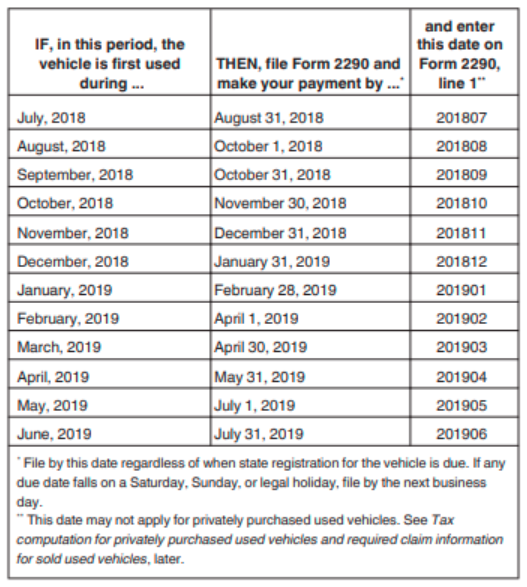

The tax period is between July 1, 2018 and June 30, 2019. Form 2290 must be filed for the month the taxable vehicle is first used on public highways during the current period. Form 2290 must be filed by the last day of the month following the month of first use (as shown in the chart below).

How?

You can file either electronically or through the mail. You can e-file by following either of these links

- IRS.gov/e-File-Providers/e-FileForm-2290

- IRS.gov/Trucker

If you aren’t filing electronically, mail completed Form 2290 to:

Form 2290 with full payment:

Internal Revenue Service

P.O. Box 804525

Cincinnati, OH 45280-4525

Form 2290 without payment due:

Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0031

How do I know what to pay?

This is a process that is best described on the IRS instructions sheet. It is on page 5 and can be found here.

Keep records year after year of your forms and dates filed/paid/mailed etc. It is important to keep a detailed recollection in case you ever need to locate it. If you are an OTR trucker without a permanent domicile, take photocopies of the forms filled out and label when you filed/paid/pail and file them electronically in a google drive account, a drop box, or wherever you safe keep your documents.

* in order to best describe this accurately, some of the following information is verbatim from the IRS Instructions page. There is a direct link to that page above this article.

- All

- Carriers

- Industry News

- Shippers/Brokers

- Uncategorized